Going to the dentist is a crucial aspect of maintaining good oral health. Dentists are medical professionals who specialize in diagnosing and treating oral diseases and conditions. They play a vital role in preventing dental problems and promoting overall wellness through routine check-ups and procedures. From filling cavities to performing root canals, dentists provide a …

Read Article: The Ultimate Dentist Guide For Healthy Teeth

Us Online Professors

Open happiness

Blue Lotus Guide: Tips For Growing And Using This Sacred Flower

Blue lotus, also known as Nymphaea caerulea, is a stunning aquatic plant with vibrant blue flowers that has been used for its various therapeutic properties for thousands of years. This sacred plant holds deep significance in several ancient cultures, where it was believed to have both spiritual and medicinal benefits. Throughout history, the blue lotus …

Read Article: Blue Lotus Guide: Tips For Growing And Using This Sacred Flower

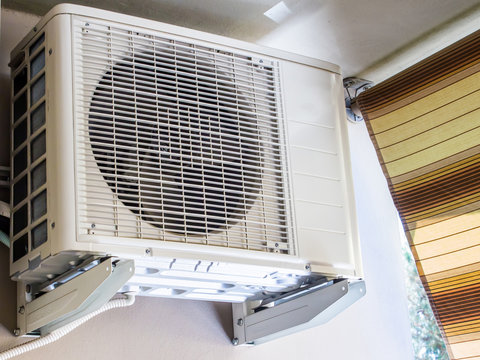

Top Hvac Repair Services Guide: Tips For Proper Maintenance

When it comes to ensuring the comfort and functionality of your home or business, having a properly functioning HVAC system is essential. Whether it’s keeping your space cool in the summer or warm in the winter, a reliable HVAC system is crucial for your overall well-being. However, like any equipment, HVAC systems can experience wear …

Read Article: Top Hvac Repair Services Guide: Tips For Proper Maintenance

Ultimate Laptop Bag Guide

Laptop bags are essential accessories for individuals who rely on their laptops for work, school, or entertainment. These bags not only protect your valuable device but also provide convenient storage for all your accessories and essentials. With a wide range of styles, materials, and features available, finding the perfect laptop bag can be overwhelming. From …

Read Article: Ultimate Laptop Bag Guide

The Best Mailing Boxes For Shipping And Packaging Needs

When it comes to shipping and packaging products, choosing the right mailing boxes is crucial. Mailing boxes come in a variety of shapes, sizes, and materials to suit different shipping needs. Whether you are a small business owner shipping out orders or an individual sending a package to a friend, selecting the appropriate mailing box …

Read Article: The Best Mailing Boxes For Shipping And Packaging Needs

Discover The Best Dental Care Tips For A Healthy Smile

Oral health is an integral component of overall wellness, and dental care plays a crucial role in maintaining a healthy mouth and body. From regular cleanings and check-ups to more complex procedures such as fillings and root canals, taking care of your teeth is essential for preventing decay, gum disease, and other oral health issues. …

Read Article: Discover The Best Dental Care Tips For A Healthy Smile

Discover The Best Commercial Projects in Toronto

Commercial projects in Toronto are a booming industry, with new developments springing up all over the city. From office buildings to retail spaces, there is no shortage of opportunities for investors and developers looking to capitalize on the thriving economy of Canada’s largest city. With a diverse range of industries calling Toronto home, there is …

Read Article: Discover The Best Commercial Projects in Toronto

How-To Use Tubidy: A Comprehensive Review

Tubidy is a popular online platform that allows users to easily search, discover, and download their favorite music, videos, and other multimedia content. With Tubidy, users can access a vast collection of songs and videos from various genres and artists, making it a one-stop destination for all entertainment needs. Whether you are looking to listen …

Read Article: How-To Use Tubidy: A Comprehensive Review

Easy aluminium windows and doors Sydney

Aluminium windows and doors have become increasingly popular in Sydney for their modern design, durability, and energy efficiency. These sleek and stylish products not only enhance the aesthetics of a building but also provide numerous practical benefits. Whether you are renovating your home or building a new property, aluminium windows and doors are a great …

Read Article: Easy aluminium windows and doors Sydney

Dental Health Experts Guide: Top Tips For Better Oral Care

Good oral health is essential for overall well-being, and dental health experts play a crucial role in helping individuals maintain healthy teeth and gums. These professionals are highly trained and knowledgeable in various aspects of oral health, including preventive care, treatment of dental issues, and cosmetic dentistry. Whether you are looking for routine cleanings and …

Read Article: Dental Health Experts Guide: Top Tips For Better Oral Care